Leading and pioneering investment bank in Sri Lanka Asia Capital PLC (ACAP) will soon broad base the shareholding to be in compliance with public floating requirements stipulated by the Listing Rues of Colombo Stock Exchange.

“We will soon look at opportunities of broad basing our public float to match with Colombo Stock Exchange’s Rules on minimum public holding” ACAP Chief Executive Officer and Executive Director Stefan Abeyesinhe said.

He further said that soon after Nishan Sumanadeera was appointed as legal and financial consultant in September this year, the company has undergone initial phase of restructuring and had almost sorted all the business-related concerns with Japanese investors.

“We are on the process of relooking and focusing at Asia Capital’s astute investors and our best assets in order to financially re-engineer them to be the key revenue generating assets to sustain the balance sheet with the guidance of our consultant team appointed by our key shareholders” Abeyesinhe assured highlighting on the latest initiatives by ACAP group.

Current market capitalization of ACAP is valued at nearly Rs. 1 billion represented by 131,329,995 ordinary voting shares according to latest financials as at 30th September 2020.

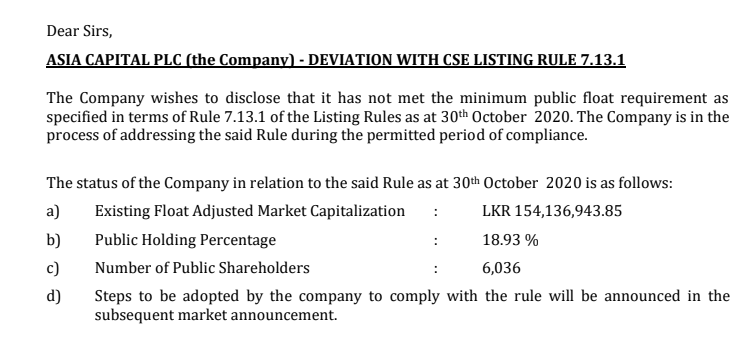

Colombo Stock Exchange (CSE) listing rules currently outline that Listed Entity whose shares are listed on the CSE shall maintain a Minimum Public Holding Requirement on a continuous basis, and thus according to the rules Asia Capital must maintain a minimum of 20% minimum public holding of shares as per the float adjusted market capitalization.

Abeyesinhe noted that ACAP has already informed Colombo Stock Exchange that the company is in the process of addressing the said Rule during the permitted period of compliance. As at 30th October 2020 Asia Capital’s existing Float Adjusted Market Capitalization stands at Rs. 154,136,943.85 with a Public Holding Percentage 18.93 % with 6,036 public shareholders.

About Asia Capital PLC

Asia

Capital PLC started as a securities trading company in the early 1990s,

specialising in stock brokering, and later expanded its business portfolio to

encompass the larger share of the investment banking market in Sri Lanka.

As Asia Capital PLC (ACAP), the company ventured

into diverse industries and sectors to fulfil the vision and become a

powerhouse providing value-added investment opportunities and unmatched wealth

creation services. Currently, operations consist of leisure, project

management, investment banking, and advisory services.

Asia Capital also has a presence in property

management, real estate, asset management and information technology services.

Asia Capital PLC’s 76% is owned by Malaysians whilst 16% is owned by Japanese

investors.